What is WE BUILD Consortium and why does it matter?

The need for a European digital identity solution is clear. According to Mario Draghi’s “Future of European Competitiveness” report, in 2024, 55% of SMEs view administrative burdens as a major hurdle, with some spending up to 2.5% of their turnover on manual compliance tasks. To stay competitive and grow, Europe needs to make the most of new technologies — and the WE BUILD Consortium is right at the forefront.

This new large-scale pilot co-financed by the European Commission brings together public authorities, private companies, universities, and technology providers to test practical business solutions and implement real-life use cases. With over 180 organizations from 30 countries, the WE BUILD Consortium represents an unprecedented effort in cross-sectoral and cross-country collaboration.

Procivis is proud to be a beneficiary partnerproviding the technology that turns vision into action. Our infrastructure helps deliver solutions for millions of businesses, no matter which country they operate in. Production-ready and fully compliant with European regulations, Procivis supports the WE BUILD ambition of piloting solutions in production with real enterprise information.

From Compliance to Confidence: Next-Gen KYC

One of the key areas in WE BUILD is Know Your Customer (KYC), Know Your Employee (KYE), and Know Your Supplier (KYS). European companies need to be confident about who they interact with while meeting strict screening and reporting requirements.

WE BUILD tackles this by piloting how to digitalize and streamline these KYx processes. With Business Wallets, companies can exchange trusted digital credentials to reduce process steps and speed up decision-making. The benefits are clear: faster cross-border business, smoother partnerships, and more time to focus on growth instead of processes and paperwork.

This approach also benefits banks. With the upcoming European AML regulation in 2027, banks will need to apply consistent KYC standards across Europe. With the help of the Procivis One Business Wallet, they can efficiently comply with these regulations.

Procivis, together with other consortium members such as Bundesanzeiger, SBB, Deutsche Bank, Commerzbank, Banca Intesa Sanpaolo, CaixaBank and Bosch, is leading the way in shaping these new processes.

Transforming B2B Payments with Business Wallets

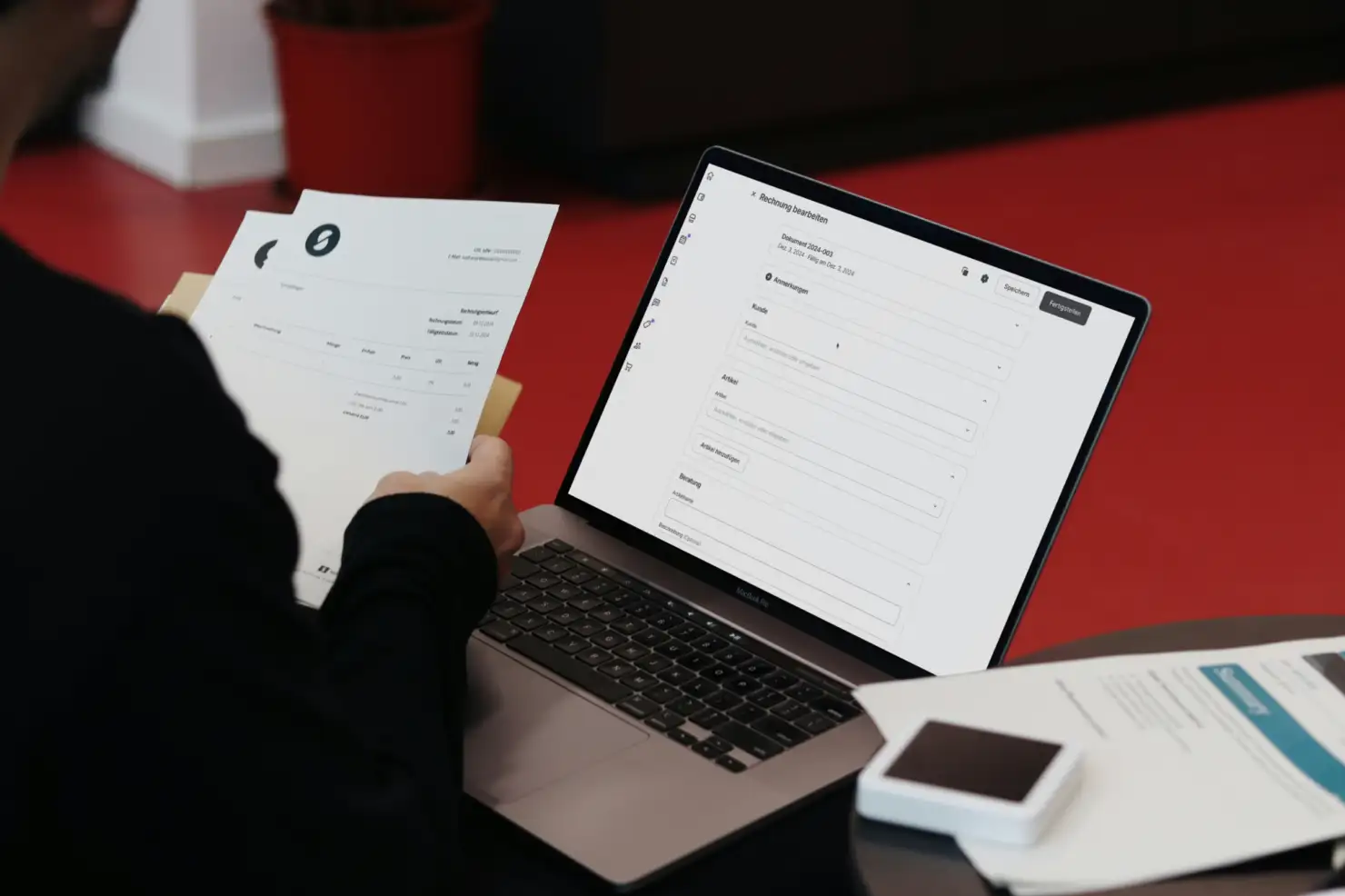

Today, cross-border B2B payments are still slow and highly manual. Many companies send invoices as PDFs, re-enter data into banking systems, and rely on paper-documents to verify partners. This not only causes delays and mistakes — it also increases costs.

The Payments Use Case within WE BUILD, where Procivis plays an active role, aims to change this. By using the Business Wallet, the entire B2B payment flow becomes smoother and more secure.

Instead of PDFs, companies can share verified digital data directly on the invoice — such as tax IDs, IBANs or certificates. This creates a trusted digital ecosystem where information is both secure and instantly verifiable.

Proving Skills with Trusted Digital Credentials

Furthermore, Procivis also contributes to the Microcredentials Use Case. The goal is simple: make learning achievements, certificates, and skills easy to recognize anywhere in Europe.

This could, for example, help students move between countries, ensuring that their learning achievements and acquired skills are still understood and recognized. At the same time, it supports a fast-changing job market, where competencies are gained in many different ways.

The project sets clear guidelines to ensure that verified skills and certificates are consistent and recognized across Europe, and it pilots their implementation.